You already own your house, the financial institution offers you the cash up front, interest builds up monthly, and the financing isn't repaid till you die or leave. There are close friends, loved ones or other roommates dealing with you. In case of fatality, your residence will be marketed so the reverse mortgage can be repaid by your estate. If you have good friends, family or various other roomies remaining at your residence, they'll likely have to abandon the residential or commercial property.

- A reverse home loan aids you obtain that money without unfavorable tax effects (it's not taxable).

- The primary threat is that your lending principal increases as the rate of interest payments are contributed to it, and rates of interest for reverse mortgages do not come inexpensive.

- Top Reasons a reverse home loan rocks as well as its a great suggestion for you.

- There are also plenty of internet lenders like One Opposite Home Loan, Liberty Equity Solutions and also Home Factor Financial Corp

- That will certainly drop to 58%, according to the Wall Road Journal.

To keep the property, they'll need to repay the complete funding equilibrium or 95% of the house's appraised value, whichever is much less. Unlike re-financing your mortgage loan, reverse home mortgages don't have a minimal credit rating or earnings demands. Qualification to get a reverse home loan is based mainly on your equity in your home, https://www.businesswire.com/news/home/20200115005652/en/Wesley-Financial-Group-Founder-Issues-New-Year%E2%80%99s together with a couple of various other elements, like your age.

Who's Eligible For A Reverse Mortgage?

There are likewise tons of fees on these car loans, making it all worse. I am not in the placement of needing a CHIP or HELOC financing at this time, but delighted I review this, as I never recognized HELOC existed. I needed to take CPP impairment as well as just needed to know what options are around, incase I remained in a position of needing aid in the future. Your remarks have actually been so handy and provided me lots to think about. While your home may remain to appreciate in value and also offset some of the interest prices and also loss of equity, interest will quickly collect on the quantity you obtain.

What Takes Place To A Residence Equity Loan When A Home Mosts Likely To Repossession?

See our Area Standards for more details and also information on how to adjust your email settings. Reverse home mortgages can be a pricey method to access a few of the worth developed in your house. Only two business use them; both welcome you to look for and also spend for independent lawful advice, to guarantee you are entering into the arrangement openly, and that you understand the contract and all risks. The financing doesn't impact OAS and also GIS, and also does not have to be paid back till you sell your residence or you or your surviving companion pass away. You can convert the equity in your house into a stack of money without needing to move out. There are also a lot of on-line lending institutions like One Reverse Home Mortgage, Freedom Equity Solutions as well as Home Factor Financial Corp

Due to start-up charges as well as greater interest rates, reverse home loans are much more expensive than conventional credit lines or home loans. Early repayment of all or a section of the quantity obtained can subject you to early repayment fines. Loaning against your house will impact the quantity readily available to hand down to your beneficiaries. Many seniors experience a considerable revenue reduction when they retire, as well as regular monthly home loan repayments can be their greatest expenditure.

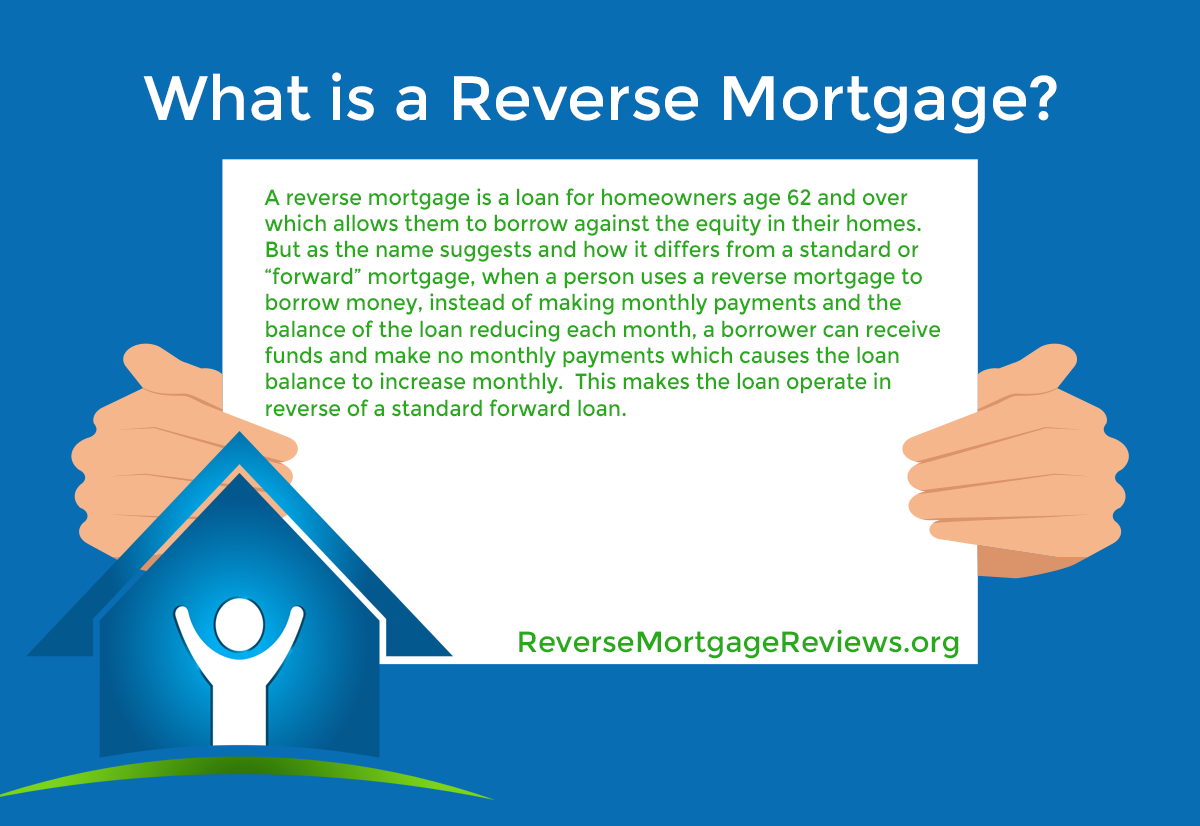

If they don't-- and also numerous have actually come under that trap-- the lender can confiscate. Reverse mortgages are designed to make it feasible for elders age 62 as well as older to use the equity of their residences by reversing repayments to ensure that the lender actually sends out payments to the consumer. Informative post As the child boomer generation remains to age, it is expected that reverse home loans will certainly continue to obtain in appeal as an efficient approach for covering living expenditures.

Think me when I tell you a reverse mortgage is a negative suggestion. Out if that cash you need to repair your home to satisfy their criteria. You have to paint your house if there is any type of broke paint, you should put in brand-new home windows if they do not meet their specs. Put on a brand-new roofing if they do need after that you obtain whatever cash is left. You can select to not make payments, after that they obtain your residential or commercial property when you leave it or die.

The regular monthly payout, in addition to costs as well as taxes, will certainly start to feed right into your residence's equity. Reverse mortgages have lots of usages, especially those surviving on set retirement revenue as well as can not take on a considerable financial emergency. https://www.inhersight.com/companies/best/reviews/flexible-hours Below are some common reasons individuals obtain reverse home mortgages. Any kind of significant fixing to the residential or commercial property will certainly be to be done prior to or while the reverse home loan is in process.